The final lesson

We have reached the end of the free crypto series!

Preethi Kasireddy

Preethi Kasireddy

We have reached the end of the free crypto series!

In this final section of the white paper, Satoshi uses math to prove how difficult it is for a dishonest attacker to double spend transactions on the Bitcoin network.

This next section is about the all-important subject of privacy, which ties into the idea of decentralization, and by now you know, was one of reason for Bitcoin’s development in the first place.

Rather than having a transaction for every cent transferred, Bitcoin structures each transaction to contain one or more different inputs and at most two outputs.

The idea behind a simplified payment verification system is to allow nodes to verify payments without needing to store the entire blockchain.

Let’s take a look at what how Satoshi envisioned optimizing the storage of Bitcoin transactions.

As you now know, nodes have to expend CPU power in order to generate a valid hash for the next block. Expending power costs money. Therefore, for nodes to willingly expend this CPU power, it makes sense that they need some sort of reward.

In this lesson, we will learn about what the Bitcoin network is and the rules by which the nodes (i.e., computers) in the network communicate.

Ready to figure out how Bitcoin resolves the issue of how we can all agree upon a valid single chain of blocks (since any set of nodes in a network can produce a series of timestamped blocks)?

In Section 3 of the whitepaper, Satoshi describes the concept of a “timestamp server” as a way to track the order of network transactions.

Satoshi begins explaining the Bitcoin system by first discussing the function of transactions, which are the most important aspect of the Bitcoin network.

In this lesson, we will read the introduction of the Bitcoin paper together and understand it line by line, just like we did with Satoshi Nakamoto’s abstract.

We are going to read the Bitcoin whitepaper and understand it together, line by line. That way, you can understand Bitcoin exactly as Satoshi Nakomoto originally intended it to be, rather than what we want it to be or what it has evolved into today (for better or worse).

In its simplest form, a peer-to-peer (P2P) network is created when two or more computers share resources directly, without needing to rely on a central computer to distribute the resources.

Digital money was a great idea, I’m sure you agree, but the cypherpunks were going to have to crack a very old problem, one that no one had ever cracked before: the double-spend problem.

The movement behind Bitcoin started decades before Bitcoin was invented, with what is today known as the “ Crypto Wars. ”

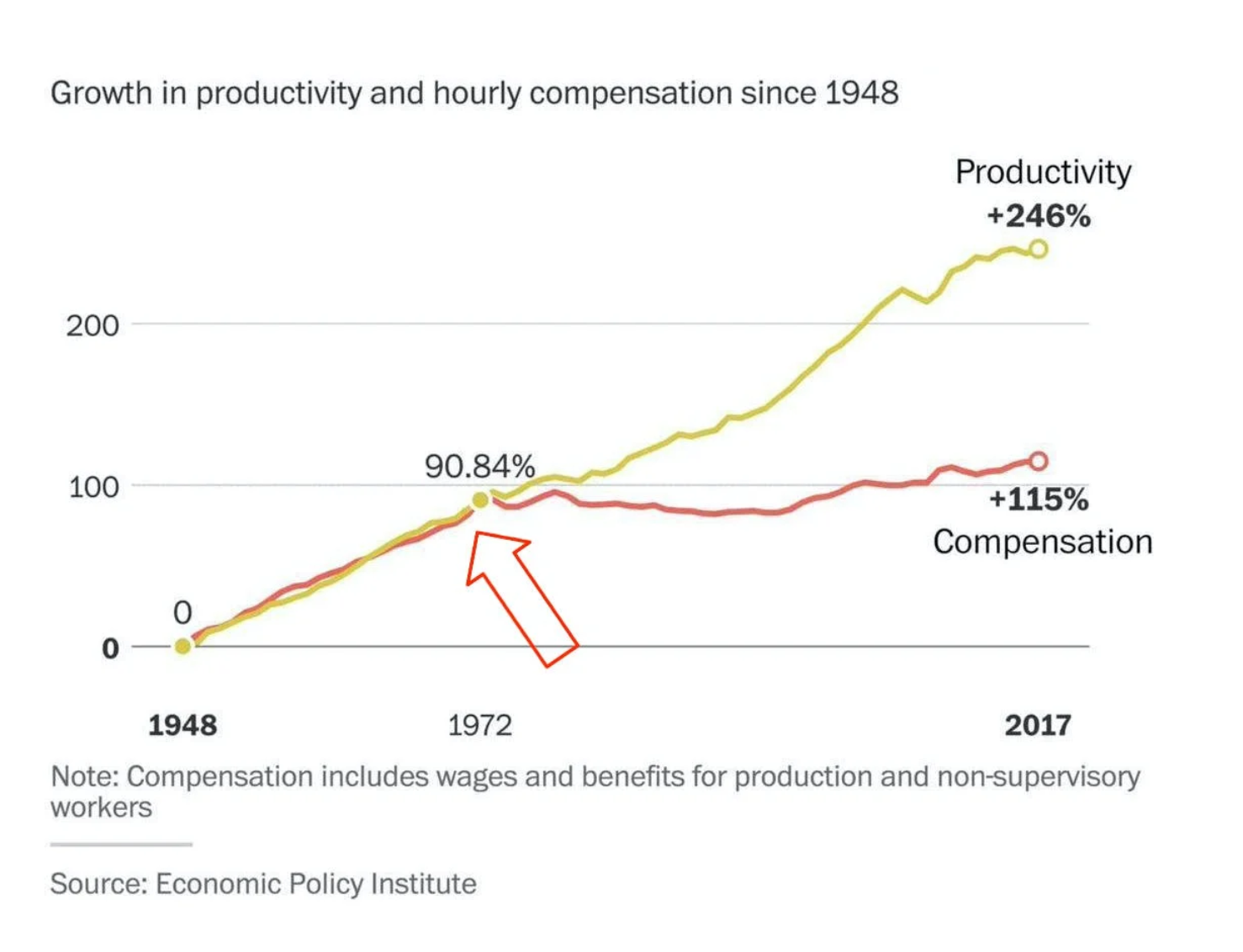

Below are a series of charts (put together by River Financial), which showcase various economic metrics pre- and post-1971.

As you can undoubtedly tell from your reading thus far, the global financial crisis revealed the weaknesses in the financial system and the need for better regulation.

The panic of 2008 threatened the stability of the global financial system at large, necessitating a large-scale intervention by the Fed.

The financial world, or more accurately, the world at large, was never the same after the 2008 financial crisis. If it were not for the crisis, Bitcoin would not have become as popular as it has become.

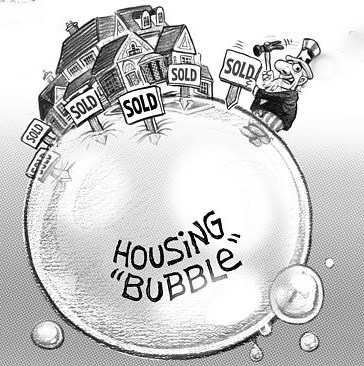

From the late 1990s until early 2006, house prices in the US soared. During this surge, mortgage lending standards deteriorated significantly and alarmingly.

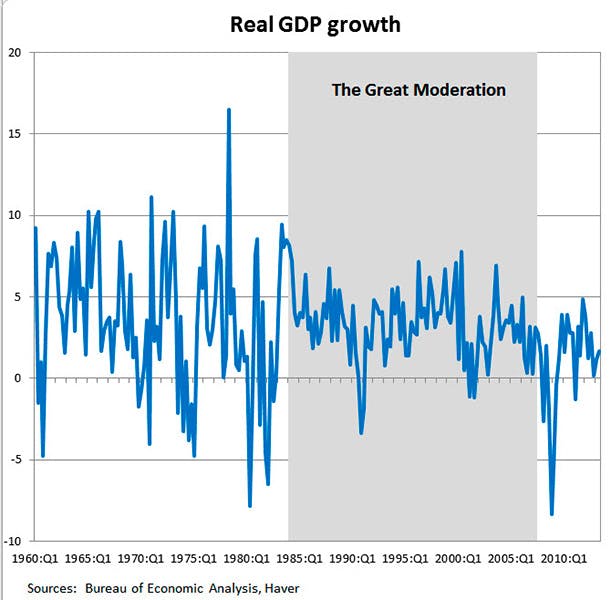

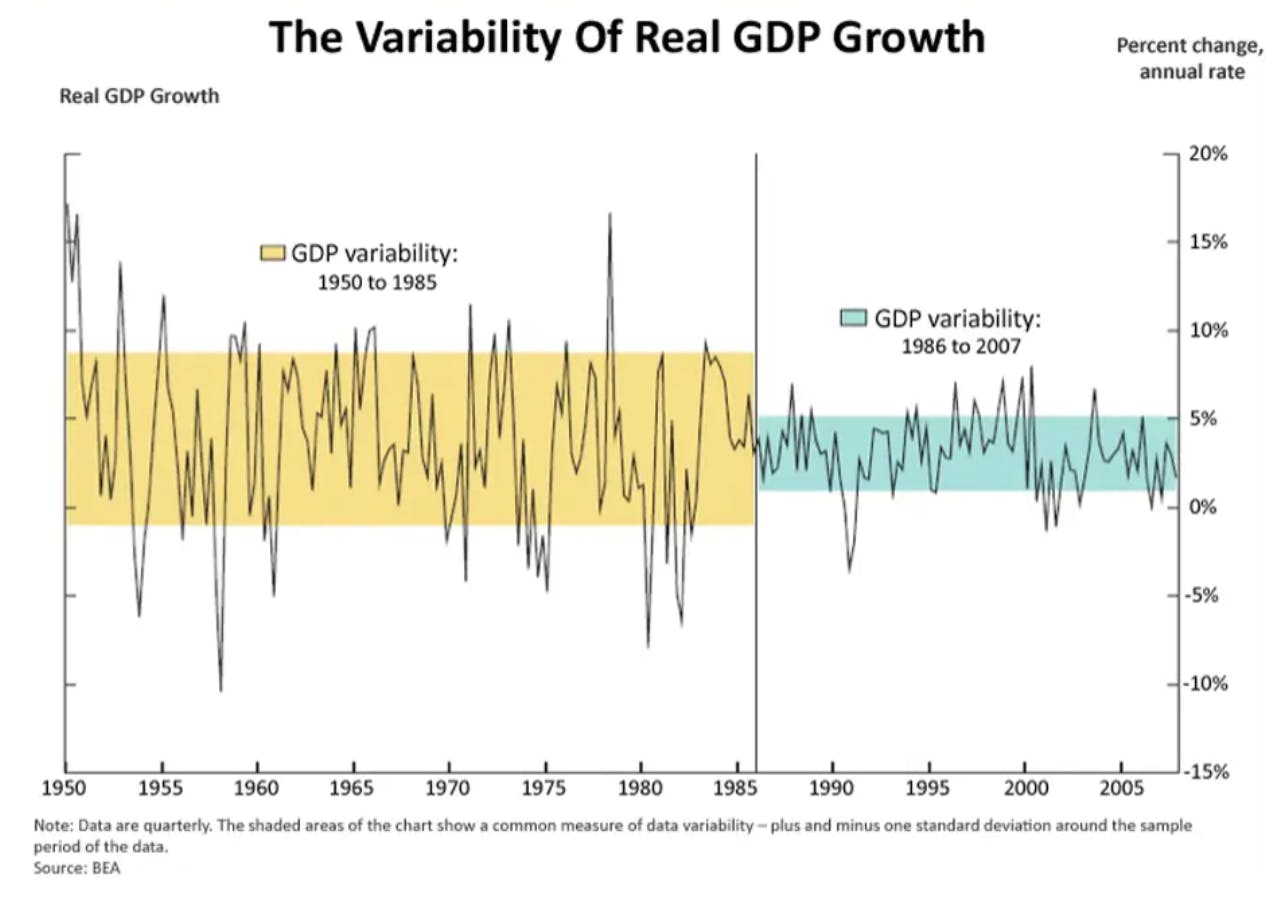

During the Great Moderation, there were still many financial shocks, but they didn’t crash the economy.

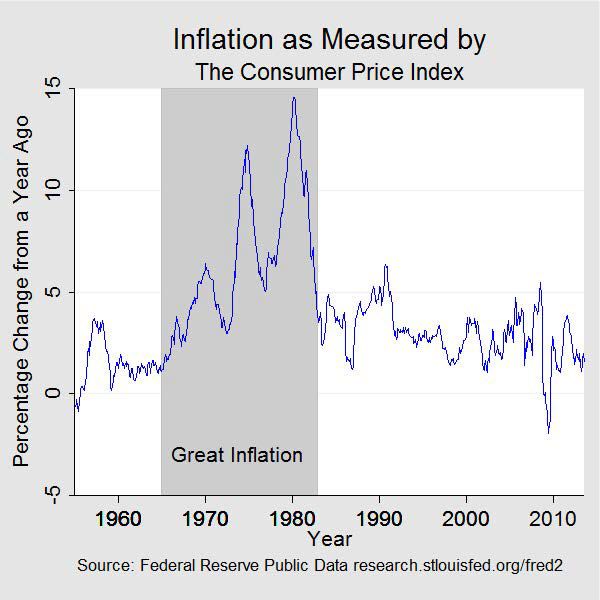

In the previous posts, we’ve discussed factors leading up to the Great Inflation which, as you know, was a period of turbulence in the US during the 1960s and 1970s. So what of the calm after the storm? Was there any? Fortunately, yes!

During this period of Great Inflation, the Fed failed to meet its mandate to keep inflation at steady and moderately low levels, thereby plunging the country into former financial difficulties.

Initially, the Bretton Woods system seemed to work well. However, this started to change in the 1960s when European and Japanese exports became more competitive with US exports.